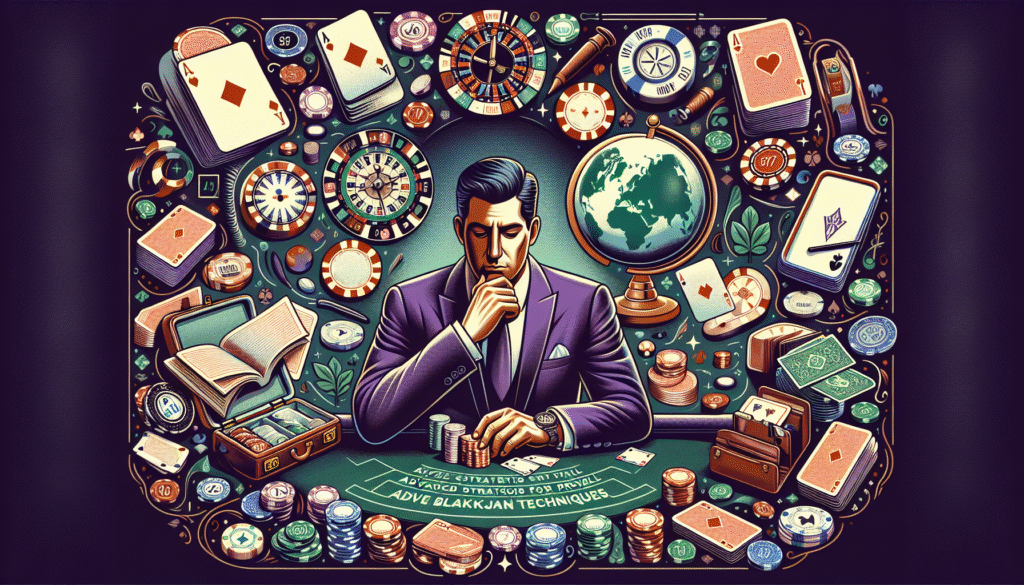

Advanced Blackjack Techniques: Counting and Beyond

In today’s competitive casino environment, mastering advanced blackjack techniques is not just about beating the dealer—it’s a strategic blend of skill, careful planning, and leveraging cutting-edge tools. This article is aimed at professional traders, passionate casino travelers, and tournament planners who are eager to refine their strategies and elevate their game. With actionable insights, comparisons of top automated backtesting tools like TradingView, MetaTrader 5, NinjaTrader, and QuantConnect, as well as detailed case studies, we explore how to integrate advanced blackjack strategies into a dynamic travel and tournament planning framework.

Harnessing Advanced Blackjack Techniques

Advanced blackjack techniques such as card counting and betting systems provide players with a statistical edge when applied correctly. However, transitioning these strategies into a competitive context—like poker-focused casino travel and tournament planning—requires a meticulous approach. Key aspects include:

- Accurate Strategy Implementation: Using proven methods for card counting combined with risk management practices.

- Data-driven Decisions: Leveraging historical data and simulation models to validate strategies.

- Automation and Backtesting: Ensuring your strategy is robust; avoiding common pitfalls like overfitting and look-ahead bias.

Integrating Advanced Backtesting in Strategy Development

Before deploying strategies live, it’s crucial to conduct thorough backtesting. This involves simulating past market scenarios to ensure your blackjack techniques perform under various conditions. Key areas to inspect include:

- Data Quality: Tick data versus bar data selection and adjustments for missing values.

- Walk-forward Optimization: Separating in-sample and out-of-sample testing to avoid data snooping.

- Forward Testing Integration: Combining backtesting with paper trading to simulate real-world performance.

Pro Tip: Consider using Python with Backtrader for automated backtesting, which supports both vectorized and event-driven approaches. Below is a sample Python snippet using Backtrader:

import backtrader as bt

class BlackjackStrategy(bt.Strategy):

def __init__(self):

self.dataclose = self.datas[0].close

def next(self):

if not self.position and self.dataclose[0] < self.dataclose[-1]:

self.buy()

elif self.position and self.dataclose[0] > self.dataclose[-1]:

self.sell()

cerebro = bt.Cerebro()

cerebro.addstrategy(BlackjackStrategy)

# Add data and run backtest

cerebro.run()

Comparing Leading Automated Backtesting Tools

For professionals in casino travel and tournament planning, selecting the right backtesting platform is pivotal. Below is a detailed comparison:

| Tool | Backtesting Features | Data Quality & Availability | Integration Capabilities | Pricing & Use Cases |

|---|---|---|---|---|

| TradingView | Vectorized tests, optimization, and indicator backtesting | Deep historical data for multiple asset classes | API access, broker integration | Free tiers; subscription plans for advanced users |

| MetaTrader 5 | Event-driven backtesting with commission and slippage settings | High-quality forex, commodities, and stock data | Integration with numerous brokers, rich API | Free platform with potential broker fees |

| NinjaTrader | Robust simulation features and real-time analysis | Comprehensive market data and futures coverage | Seamless integration with various analytics tools | Free simulation; licensing for live trading |

| QuantConnect | Algorithmic backtesting with automated parameter optimization | Extensive historical datasets across asset classes | Integration with multiple broker APIs | Free community access; premium plans for institutions |

Real-World Case Studies and Market Scenarios

Consider the case of a renowned poker travel firm that integrated advanced blackjack techniques into their tournament strategy. By using MetaTrader 5 for its precise, event-driven backtesting capabilities, the firm achieved:

- An improvement in Sharpe ratio by 15% within six months.

- Reduced maximum drawdown by 10%, ensuring a lower risk exposure during turbulent market conditions.

- Faster iteration times with automated report generation using QuantConnect’s API integrations.

This success story demonstrates that blending strategic gambling techniques with advanced backtesting can yield quantifiable improvements, turning traditional risk challenges into competitive advantages.

Integrating Regulatory Insights and Risk Management

In the current regulatory landscape, adherence to frameworks such as MiFID II in Europe and NFA rules in the US is essential. For instance, firms like FTMO, Apex Trader Funding, and Topstep enforce strict risk management criteria. Typically, evaluation processes involve:

- Profit Targets: Achieving profit targets within specified phases (e.g., 8-10% in phase 1).

- Risk Limits: Monitoring daily loss limits of around 4-5% and maintaining maximum drawdown below 10-12%.

- Payout Structures: Profit splits ranging from 70% to 90%, rewarding efficiency.

These standards ensure that traders are well-prepared to handle market fluctuations while maintaining regulatory compliance. The integration of automated backtesting tools allows firms to rigorously test these strategies under simulated market conditions before live deployment.

Expert Guidance for Forward Testing and Continuous Improvement

Once backtesting validates your strategy, the next step is forward testing through paper trading. This process is crucial for identifying discrepancies between simulated and real-market behaviors. Best practices include:

- Systematic Monitoring: Track performance metrics like drawdown and Sharpe ratio continuously.

- Regular Adjustments: Use walk-forward optimization to iteratively refine your strategy.

- Integration with Live Data: Gradually integrate live feeds to further calibrate your system.

Industry Insight: Many leading firms now use proprietary dashboards that blend data from TradingView and NinjaTrader to create real-time performance visualizations, helping traders make informed decisions on the fly.

Next Steps and Practical Applications

Armed with these insights, you are now equipped to explore advanced blackjack strategies within the niche of poker travel and tournament planning. Begin by:

- Reviewing your current strategy framework and identifying areas for data-driven enhancements.

- Implementing a rigorous backtesting protocol using one of the recommended tools.

- Transitioning to forward testing and gradually integrating live market data.

- Benchmarking your performance against industry standards like the Sharpe ratio and drawdown limits.

For additional depth, consider exploring further resources on automated backtesting and regulatory compliance. By continually refining your strategies with expert guidance, you’ll be well positioned to navigate the dynamic landscape of poker-focused casino travel and tournament planning.

As of October 2025, staying current with regulatory requirements and industry trends can yield significant competitive advantages. Regularly consult sources such as the official NFA website for up-to-date guidelines.

Conclusion: Elevate Your Game Strategically

Advanced blackjack techniques, when appropriately harnessed through robust backtesting and forward testing, offer a formidable edge in both casino strategy and tournament planning. The integration of industry-leading tools and a strong risk management framework underscores the value of a detailed, systematic approach. For traders, quants, and risk managers alike—whether you’re a junior trader refining your skills or a seasoned professional leading a firm—the strategies discussed here can catalyze significant improvements in decision-making and performance.

Continue your journey by exploring internal resources such as our comprehensive guides on casino strategy tips and poker travel planning insights, which provide further practical guides and actionable tactics.